We started with a system I call caged trees, where each supporting shade tree received a 1m high ring of wire fence, which we filled first with coconut husks and then cocopeat. The vanilla thrived at first, so our second major method of a raised bed filled with cocopeat was not repeated after the first trial in Garden 4.

However, after two years the caged trees stop growing. The raised bed trees keep going. So we changed to the raised bed system, which when you think about it makes far more sense, because it has massive capacity for a huge root system.

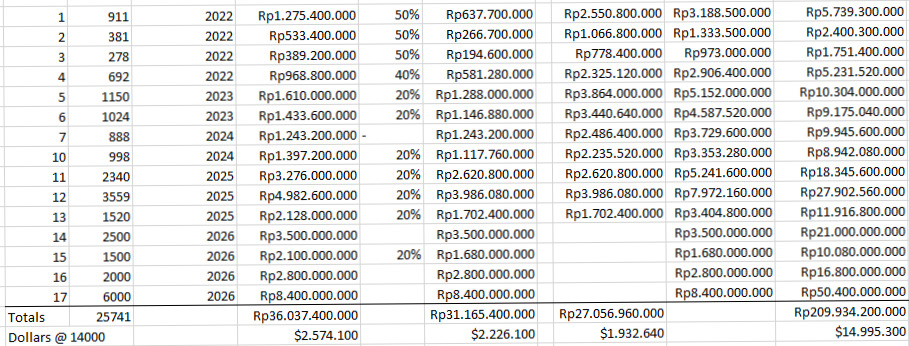

The value of the company is of course the assets, our gardens, and there we have difficulty. Normally, a company buys an asset and values it at the purchase price. According to accountants. So our gardens are worth what we pay to rent the land, the cost of the young plants and the compost and materials. Which is very little. Certainly nowhere near what we would accept for a sale.

Recently, there has come about a valuation known as the Discount Cashflow system, whereby you calculate the likely income over the lifetime of the asset and discount it. This also doesn’t work for us, because first our way of growing means the vanilla is eternal, always producing, and secondly we cannot confirm the annual yield or the price of the vanilla.

When a company is sold, it can be valued at the profit for the next five years. I thought I would do a calculation more along these lines, as it gives us a reasonable result, not too excessive and still conservative enough to calm my doubting self.

Here is a listing of our gardens, our assets, with the following assumptions:

Gardens 8 and 9 are planted to fruit trees, mainly avocado, as too steep for vanilla. 6 and 7 are still caged trees, all the others are now raised bed.

Note that the asset value over 5 years, at half the expected sales price, is nearly $20 million. Yet we have it down in our prospectus at $5 million. And any half-way decent MBA would use the 10 Year value, which says our assets are worth over $100 million dollars.

That means your shares are worth ten times what you paid for them already!!! If you have an MBA, of course.

We are continuing to be conservative, otherwise we would be selling the shares for a great deal more!

REX SUMNER

Chairman Royal Spice Gardens

Royal Spice Gardens is an Indonesian Foreign Investment Company, in Indonesia known as a Perusahaan Modal Asing (PMA).

NIB Licence number 0220100502286. NPWP: 94.830.504.0- 905.000.

PT Royal Spice Gardens Indonesia, Jl. Raya Pejeng, Tampaksiring, Gianyar, Bali 80552, Indonesia

Website by Simia Solutions / Cre8 Design Studio

Powered by Pak Kriss’s Compliance Framework.

Even in uncertain times, credible, stable & realistic opportunities are available for the astute investor.

Get the edge by obtaining clear, concise and rapid information. Fill out the form to receive our latest prospectus!